All Categories

Featured

:max_bytes(150000):strip_icc()/DebtRelief-BestDebtReliefCompaniesImage-65c32a5716014aeca3a4e55477cb8130.png)

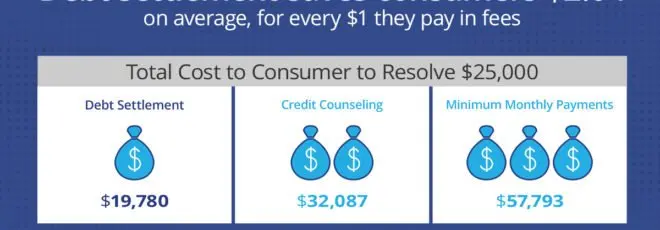

Whichever your scenario is, consider talking with a certified credit history therapist, a personal bankruptcy lawyer, or a qualified financial debt expert before moving on. They can assist you obtain a complete understanding of your funds and choices so you're much better prepared to make decisions. One more aspect that affects your options is the type of debt you have.

Kevin Briggs was an effective property manager with a six-figure revenue, yet after a year of pandemic obstacles, he discovered himself in 2021 with $45,000 in charge card financial obligation."I was in debt method over my head," Briggs claimed. "It seemed like I will shed whatever. Then I got rescued."Much less than three years later on, Briggs had actually removed his credit report card debt, many thanks to that rescue a brand-new not-for-profit financial obligation alleviation program from InCharge Financial debt Solutions called "Credit rating Card Financial Obligation Forgiveness."Credit History Card Financial obligation Mercy, additionally referred to as the Much less Than Full Equilibrium program, is financial obligation alleviation for people who have not been able to make charge card payments for six months and lenders have billed off their accounts, or are regarding to.

The catch is that not-for-profit Debt Card Financial obligation Mercy isn't for everyone. To qualify, you must not have actually made a settlement on your bank card account, or accounts, for 120-180 days. On top of that, not all creditors take part, and it's just offered by a couple of not-for-profit credit rating counseling companies. InCharge Debt Solutions is one of them.

"The various other emphasize was the attitude of the therapist that we could get this done. I was seeming like it had not been mosting likely to happen, but she maintained with me, and we got it done." The Charge Card Forgiveness Program is for individuals that are up until now behind on charge card settlements that they are in serious financial problem, possibly encountering personal bankruptcy, and don't have the revenue to catch up."The program is especially designed to help customers whose accounts have been charged off," Mostafa Imakhchachen, customer treatment professional at InCharge Debt Solutions, stated.

Not known Details About Documents to Prepare When Pursuing Bankruptcy Counseling

Creditors who take part have concurred with the not-for-profit credit score counseling agency to approve 50%-60% of what is owed in fixed monthly repayments over 36 months. The fixed payments imply you know precisely just how much you'll pay over the payment duration. No rate of interest is charged on the equilibriums throughout the reward period, so the repayments and amount owed don't change.

Latest Posts

The Basic Principles Of Rebuilding Your Credit History the Strategic Way

"Job Loss and Debt: Building a 90-Day Survival Plan with a Counselor Is Embarrassing" Corrected - The Facts

Navigating Financial Obligation Mercy in 2026: Searching For Legitimate Alleviation in a Crowded Market

More

Latest Posts

The Basic Principles Of Rebuilding Your Credit History the Strategic Way

"Job Loss and Debt: Building a 90-Day Survival Plan with a Counselor Is Embarrassing" Corrected - The Facts

Navigating Financial Obligation Mercy in 2026: Searching For Legitimate Alleviation in a Crowded Market